Unveiling Efficiency: Embracing Positives in Negatives

The Power of Negative Working Capital and a Negative Cash Conversion Cycle

In the world of finance, negative numbers often carry a stigma, conjuring images of deficits, losses, and unfavorable outcomes. Positive net profits and positive margins are celebrated as hallmarks of a thriving company. However, playing on words from the popular novel: Animal Farm, not all negatives are created equal. Amidst the sea of traditional financial metrics, there exist two elusive gems that, surprisingly, can be signs of highly efficient operations - the Negative Cash Conversion Cycle (CCC) and the Negative Working Capital.

Working Capital represents the funds needed to carry through a businesses day to day operations. It simply is a snapshot of a businesses ability to manage short term obligations and operations. It is calculated as the difference between current assets and current liabilities.

Working Capital = Current Assets - Currents Liabilities

A positive working capital occurs when current assets are greater than current liabilities. This is indicates that the business has enough cash to meet its short term financial obligations and is often applauded by investors.

A negative working capital occurs when current liabilities exceed current assets. Although this seems counter intuitive this should not ring alarm bells. A negative working capital can be evidence of a highly efficient business and can hold a strategic advantage. A negative working capital is achieved when a business collects cash upfront from its customers for goods/ services that will be delivered in the future. Thus the business has the advantage of using customers payments to fund day to day operations thus decreasing the need for external financing.

Source: CFO Perspective

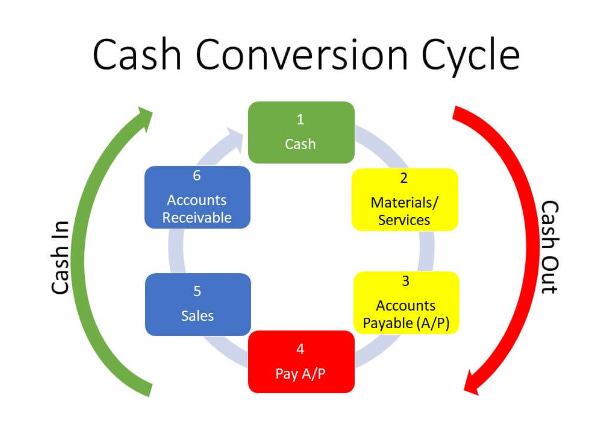

The cash conversion cycle(CCC) measures in days the time it takes for a “company to convert its investments in inventory and other resources into cash flows from sales.” It is an attempt to measure how long each net input dollar is tied up in the production and sales process before it gets converted into cash received. It is calculated by taking into account the days in inventory(DIO), days sales outstanding(DSO) and days payable outstanding(DPO).

CCC= DIO + DSO - DPO

Days In Inventory: Measures the days a company holds its inventory before selling it. We want DIO to be as short as possible as it indicates rapid sales and a better turnover

Days Sales Outstanding (Receivables): Measures the days it takes for the company to collect payments from its customers. We want DSO to be as short as possible, who doesn’t want their cash in their hands as soon as possible?

Days Payable Outstanding: Measures the days it takes for the business to pay its suppliers. We want DPO to be as long as possible, we want the business to drag its feet when it times to pay the supplier. A longer DPO is achieved via increased bargaining power.

DIO= (Avg Inventory/ COGS) x 365 days

DSO=(Receivable/Revenue) x 365 days

DPO=(Payables/COGS) x 365 days

When it comes to the CCC, the lower the better. If the CCC is increasing, one should be wary as this means cash is getting stuck as inventory for a longer period of time. This suggests there are inefficiencies in managing inventory, slow collections from customers and aggressive payment terms with suppliers; basically the signs of a horrible business. An increasing CCC can strain a company’s liquidity.

A negative CCC indicates that a company is able to convert its inventory to cash before it has to pay suppliers for that inventory, thus minimizing the time the businesses working capital is tied up in the operating cycle. A negative CCC is achieved by :

Selling inventory rapidly

Collecting payments from customers promptly

Paying suppliers at a later date

Lets look at Amazon and calculate its cash conversion cycle for 2022.

DIO=42 days

DSO= 31 days

DPO= 100 days

Thus Amazon’s CCC= 43 + 31 - 100 = -26

This calculation allows us to see that Amazon waits a whole 100 days before paying its suppliers!! Talk about bargaining power.

This post proves that investors should not view all negative numbers with a negative light, as some negative metric numbers are sign of a highly efficient operation. Not all negatives are cast from the same mold.

If you want to know your way around financial statements, I recommend reading Warren Buffett and the Interpretation of Financial statements

love this

great take, keep it rocking, cheers!