Decoding ROIC

Analyzing Returns on Invested Capital for Business Success

Aswath Damodaran writes that finance operates on a fundamental belief that the value of a business hinges on the cash flows it is expected to generate. To generate these cashflows, management must invest capital into growing the business. However not all growth creates value, this post will go into how the intelligent investor can separate the chaff from the grain by differentiating between value creating growth and value eroding growth.

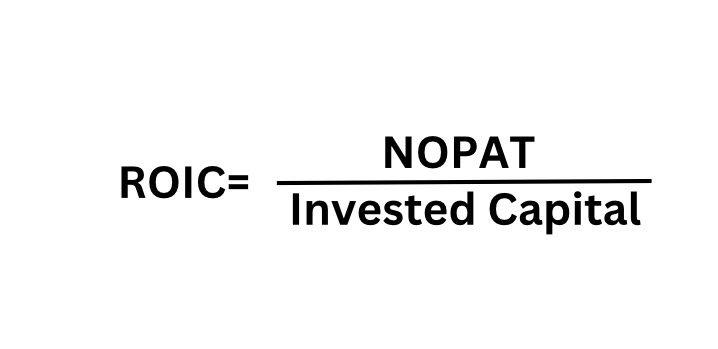

Return on Invested Capital (ROIC) is a financial metric that measures the “rate of return a company makes on the cash it invests in the business.” We can use ROIC to determine whether growth is creating or eroding value. Growth only creates value only when ROIC is greater than the cost of capital (ROIC > COC), and growth erodes value when ROIC<COC.

How do we calculate ROIC? I must point out that different investors use different formulas to calculate ROIC, with all of them claiming one formula is more comprehensive than the other. With which ever formula you pick to use, one should make sure that its simple and conservative.

NOPAT= Operating Income x (1 - tax rate)

Invested Capital= (Total Debt + Total Shareholders Equity) - NonOperating Income

I would like to present a great analogy shared by Thomas Chua: “Imagine if a company was a car, NOPAT would be the distance you could travel(how much profits were made) and Invested Capital would be the amount of fuel in the tank(resources used).” Ideally we want a car(i.e. a business ) that can travel the furthest distance using the least amount of fuel.

Lets gets into some of the mathematics of ROIC.

Don’t worry, I will keep it as simple as possible.

Let’s create two hypothetical companies: Moat Inc and Commodity Inc. Both these companies have an EPS of $1 and an ROIC of 20% and 8% respectively. They would like to grow their earnings by 6% in the next year, what percentage of their profits should each company invest to achieve this desired growth?

Moat Inc

Reinvestment Rate x ROIC = Earnings Growth

Therefore Reinvestment Rate = Earnings Growth/ ROIC

= 6%/ 20%

=30 %

Commodity Inc

Reinvestment Rate = Earnings Growth/ ROIC

= 6%/ 8%

=75%

So to achieve the same level of growth, Moat Inc will need to reinvest a smaller percentage of its profits when compared to Commodity Inc, due to Moat Inc having a higher ROIC . Thus Moat Inc has a greater cash pile that it can distribute back to its shareholders.

In an earnings obsessed Wallstreet, ROIC hardly receives the attention it deserves. CEO’s often go on CNBC and boast about record high earnings growth and never mention ROIC. This hyperfocus on earnings can result in companies straying away from a value creating path.

In Valuation by McKinsey, it is pointed out that Costco and Brown Forman both achieved annual shareholder returns of 15% between 1966 and 2017, even though Costco grew its after tax operating profits by 11% per year and Brown Forman only grew them by 7%. How then did they achieve the same shareholder returns? This is because Brown Forman had an ROIC of 29% while Costco only had a ROIC of 13%.

This illuminates the importance of ROIC in value creation.

To create the most value, high ROIC companies should focus on growth while low ROIC companies should focus on improving their ROIC by: “increasing their profits, selling unproductive assets, speeding up inventory turnover and improving capital structure.”

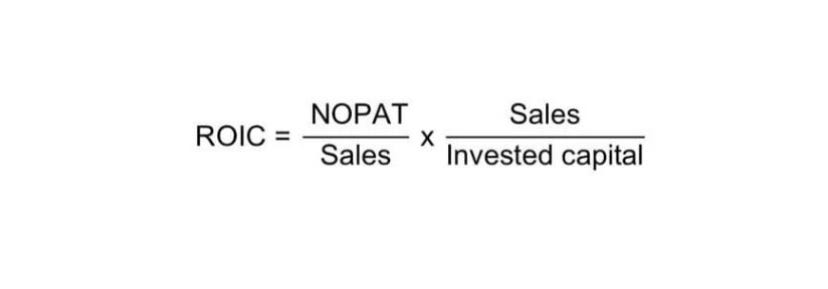

High ROICs tend to regress to the mean as they attract competition and new entrants into the market which erodes these excess returns. To maintain a a high ROIC a company must have a competitive advantage to fend off competition. Using the Du Pont analysis we can use ROIC to assess a companies competitive advantage.

Thus a company can achieve a high ROIC via two ways:

a high NOPAT margin( profit margin)

a high turn over

We would expect Hermes, a luxury retailer, to have a high NOPAT margin and low turn over and Walmart to have a low NOPAT margin and high turnover as it is a low cost retailer. The intelligent investor must analyze how a company achieves its high ROIC so as to know which competitive advantage the company possess.

In conclusion, ROIC stands as a crucial metric for assessing a company's efficiency in generating profitable returns from its investments. By decoding ROIC, we gain valuable insights into a company's operational effectiveness, capital allocation strategies, and overall financial health. With a thorough understanding of ROIC, investors, managers, and analysts can make informed decisions, identify areas for improvement, and unlock the path to sustainable growth and success.

Do you want to improve your valuation skills? Sign up to join this free valuation webinar hosted by Brian Feroldi, Brian Withers and Brian Stoffel:

thank you, ROIC is king ... ROIC > WACC and there you go ;)

https://substack.com/@atc3/note/c-104730734?r=5g11d4