Betting on the family tree

Why Family-Owned Businesses Outshine the Rest and Result In Greater Shareholder Returns

You pack your fishing gear in the back of your van and take a little trip to the river hoping to catch some fish. The river is wide and vast, thus where do you cast your line? Many experienced fisherman will advice you on certain areas of the river where you most likely to haul in some fish, for example at current breaks. We can us this same thinking when it comes to investing in stocks, there are over 55 000 publicly traded companies, so where does the intelligent investor start fishing if they are to achieve above average returns.

This is the simple concept of fishing were the fish are.

The answer lies in Family Owned Businesses

A family-owned business is a company in which the majority of the ownership and control lies within a single family or a few families.

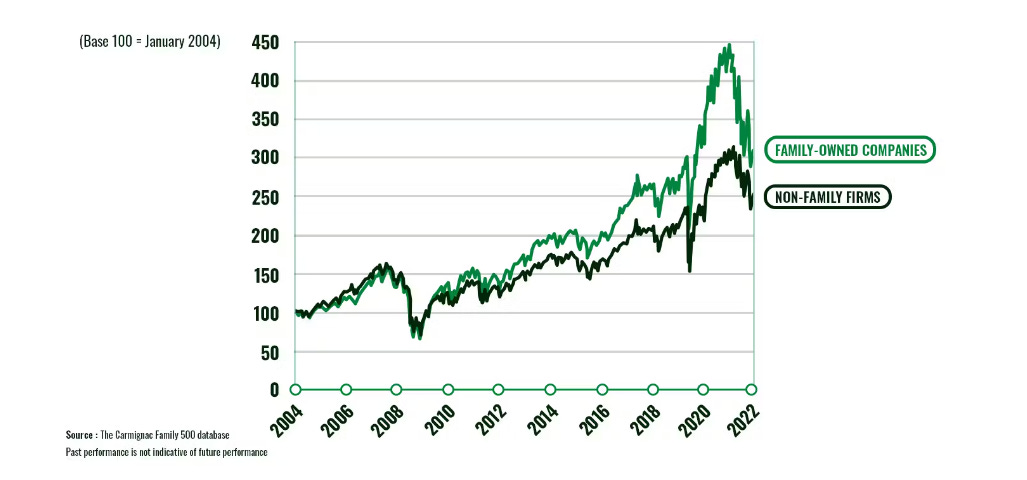

Research indicates that family-owned businesses have significantly outperformed non-family businesses and this is common knowledge amongst investors. But what is not really understood is why this occurs. Research by McKinsey noted that in terms of total shareholder returns(TSR) , family owned business outperformed non family owned businesses by 14%.

Now let’s go into the factors that results in this outperformance

Family group has lower expectations of what they expect to receive

Family-owned businesses often excel due to their owners' willingness to reinvest a larger portion of profits back into the company. Unlike non-family businesses, where shareholders may expect significant dividends, family owners typically have lower profit distribution expectations. This means they retain more earnings within the business, creating a surplus of free cash available for reinvestment in growth opportunities, innovation, and long-term sustainability. As a result, family-owned businesses can often allocate capital more efficiently and strategically, driving higher levels of performance and resilience over time.

Committed and Loyal Management

For the family, being in a management is more than just a job to them- there is a unique level of commitment and loyalty that they posses. This is in contrast to external managers who may focus on short term gains and career advancement. Management thus stays in the business for long periods of time allowing them to have an intimate understanding of the business and the industry with which it operates.

Skin In The Game

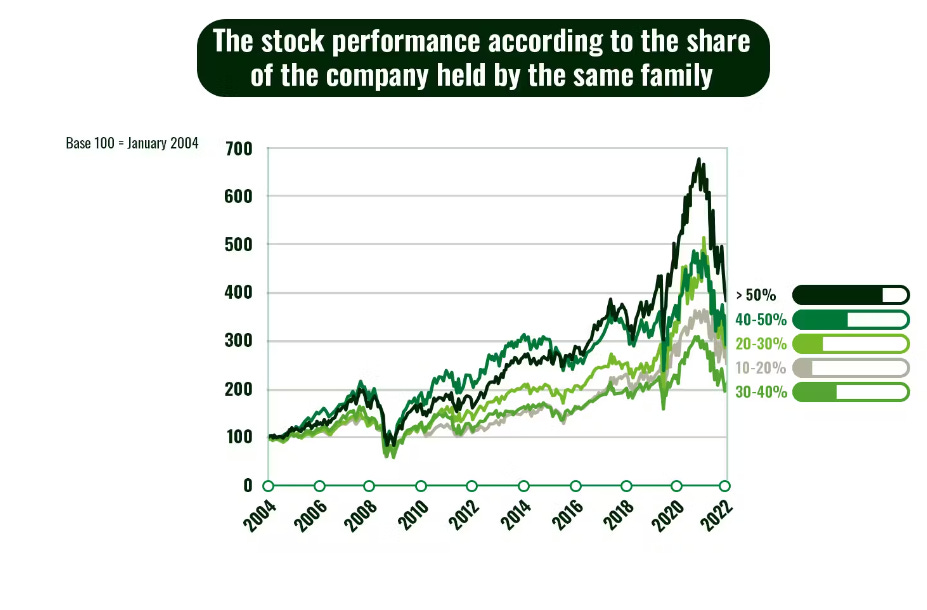

In family owned businesses, the family owns a large percentage of the stock and their net worth is largely attached to the stock. This provides motivation to ensure the long-term success of the business. The management is also aligned with the rest of the shareholders in terms of creating shareholder value.

The above chart by Carmignac further cements this point, as it indicates that the greater the percentage of the company being owned by the family the greater the outperformance.

Long term view

Family businesses have usually been passed down from generation to generation. Thus the current owners view themselves as stewards more than owners and are highly focused on legacy preservation. They thus make decisions focusing on the long term and ensuring the longevity of the business

Due to their high ownership stake/ voting rights they are immune to pressures from analysts/ shareholders/ board that can pressure them into making decisions that will boost near term earnings but destroy value in the long run.

Conservative Capital Structure

Family owned businesses tend to have a conservative capital structures and are adverse to taking on too much debt- they have antifragile balance sheets. During good times, this causes family owned businesses to have slower growth but when times get rough, they are not in danger of going bust.

Family owned businesses are more focused on resilience than break-through growth

Efficient decision making process

The decision making in family owned businesses is centralized as the decision is greatly influenced by a single individual or several members of the family. This results in a flexible business which can quickly react if the need to arises.

Established relationships and influence

The family is often well entrenched in the environment in which they operate. Thus over the years they have forged relationships and influence which they can use to influence local legislation to their benefit.

Diversification

A study conducted by McKinsey found that 40% of the family owned business outperformers had more than half of their revenues coming from non core businesses. This is further evidence of the risk aversion of family owned businesses- they do not have all their eggs in one basket. This also reduces volatility of their stock as if a certain market is not performing well, the business will still be sustained by the other markets the business is involved in.

Investing in family-owned businesses offers unique advantages stemming from their long-term orientation, conservative capital structure, and diversified operations. With a strong sense of stewardship, commitment to legacy, and emphasis on relationships, these businesses demonstrate resilience, stability, and potential for sustained growth, making them appealing opportunities for investors seeking both financial returns and enduring value.

That’s all for today. Feel free to ask any questions in the comments or recommend any topics you would like to see me cover.

great take, thank you!